Salary payments & Taxes

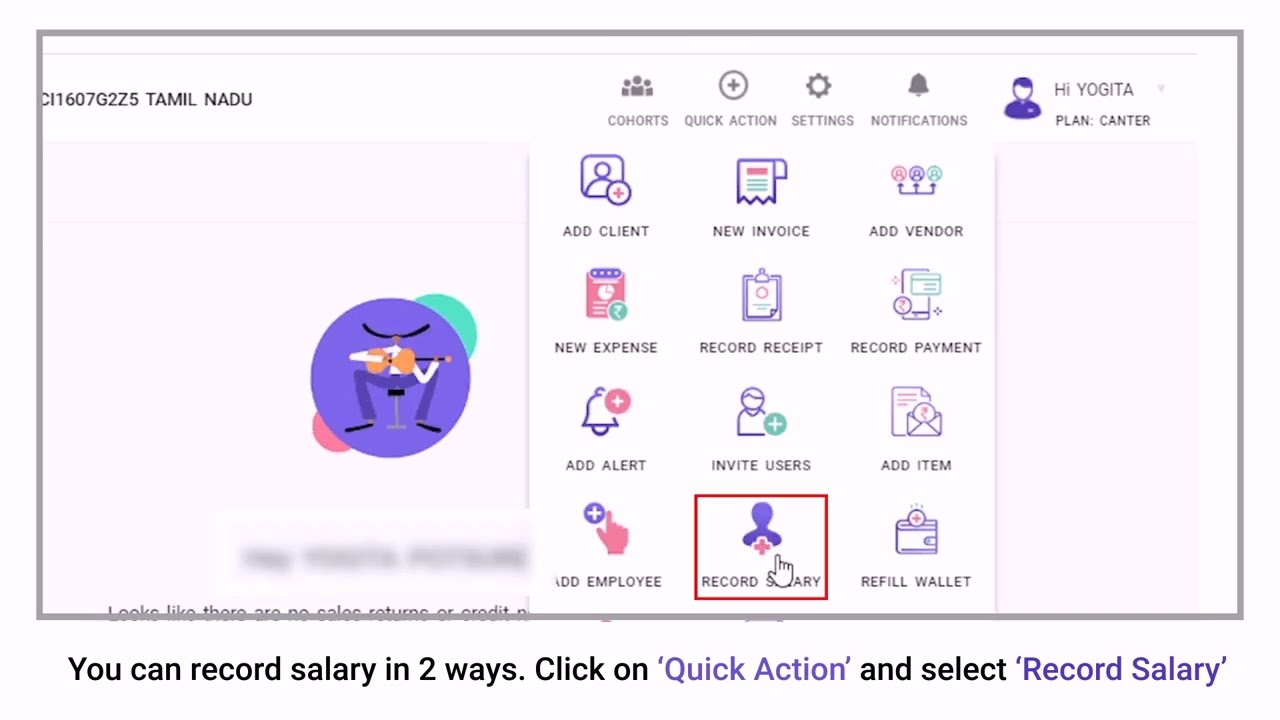

Record salary expense and payment with ease

Multiple currencies available for employees based away from home country

Auto recording of employees wise TDS, EPF, ESIC, Gratuityetc. for ease in payment

User-friendly approach for small business to recording all your employees, their salary details, appraisal, leaves, expense vouchers and tax payables

Record salary expense and payment with ease

Multiple currencies available for employees based away from home country

Auto recording of employees wise TDS, EPF, ESIC, Gratuityetc. for ease in payment

Calculate and disburse salary in international currency

Automatically calculates the forex gain/loss for each month

Auto-updates all tax calculations and accounting entries

Employees can log in and make and view their expense vouchers

View and download salary slips & monitor monthly TDS deducted

Unified notice board to view policies, holidays, events and announcements

Link your Bank Account with Xebra® for faster salary payouts

Secured, one-click disbursements and auto-reconciliation of bank accounts

All accounting reports are auto-updated and tallied

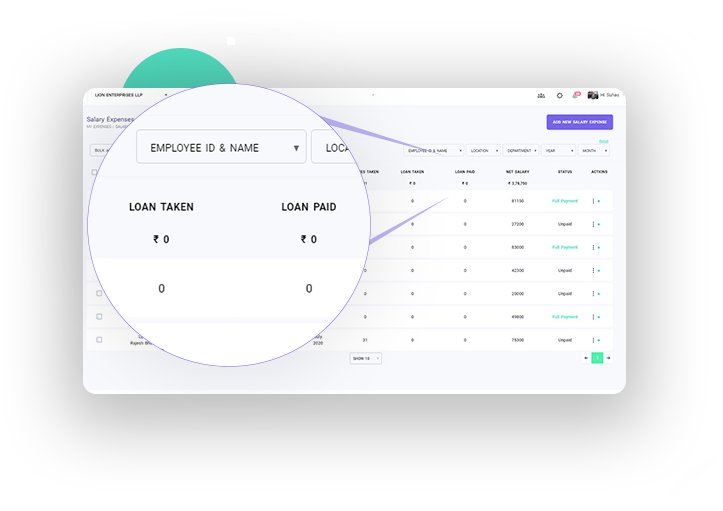

Get a clear picture of loan and amount advances given to each employee

Know paid and outstanding loan amount for each employee

Integrated feature of loan approval and EMI based payout with salary

View leave summary for employees with auto calculation of salaries

Alerts on important employee event like confirmation, appraisal, birthday and anniversaries

Assign, manage and track various assets allocated to employee

Quick employee onboarding, even for remote employees

Employee records stored digitally at a central place

Central notice board for induction and policies

Customize expense voucher approval process as per your organization rules

Employee expense vouchers can be attached directly with the client's invoice

Record & pay expense vouchers of foreign located employees

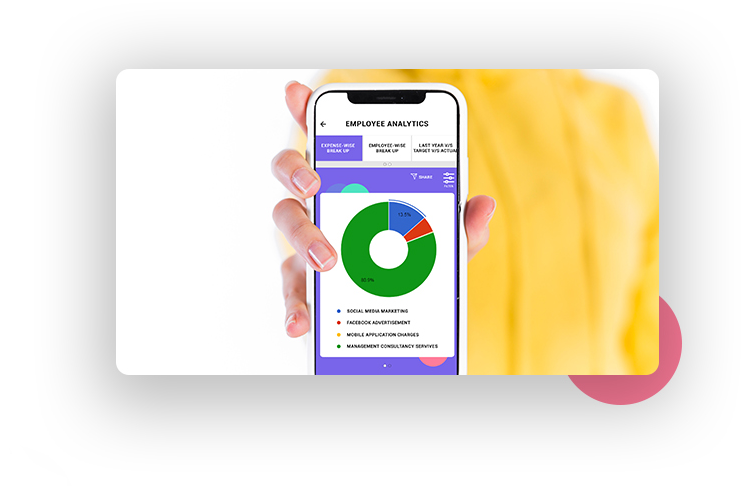

Eliminate wasteful spends by getting employee expenses break-up

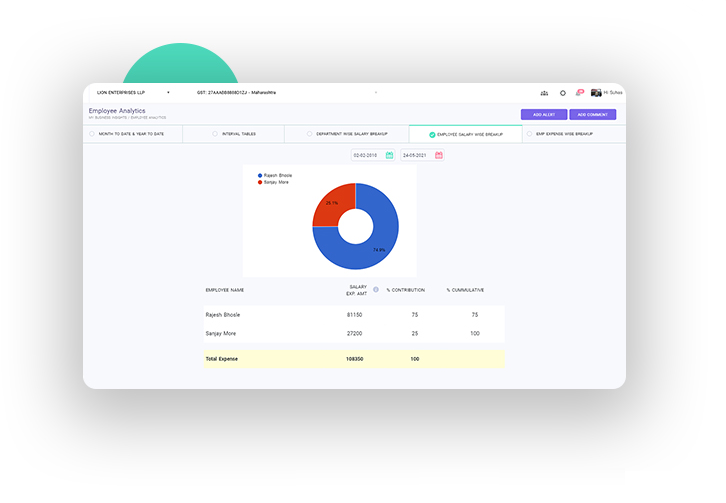

Track MTD, YTD and month-wise employee salary outgo

Map your resources bt getting department wise employee and salary break-up

An employee can record their expense vouchers from the mobile app

Monitor department and expense wise graphs on the go

Download the salary slip with one-click

Record the joining or annual performance bonus and incentive

Track all advances given to employees and payback of those

Calculate the gratuity and superannuation of your retired employees

Employees can upload investment documents for tax calculation

Upload your investment details for the year

Download form 16 for specific financial years

Auto calculates and records TDS for all employees

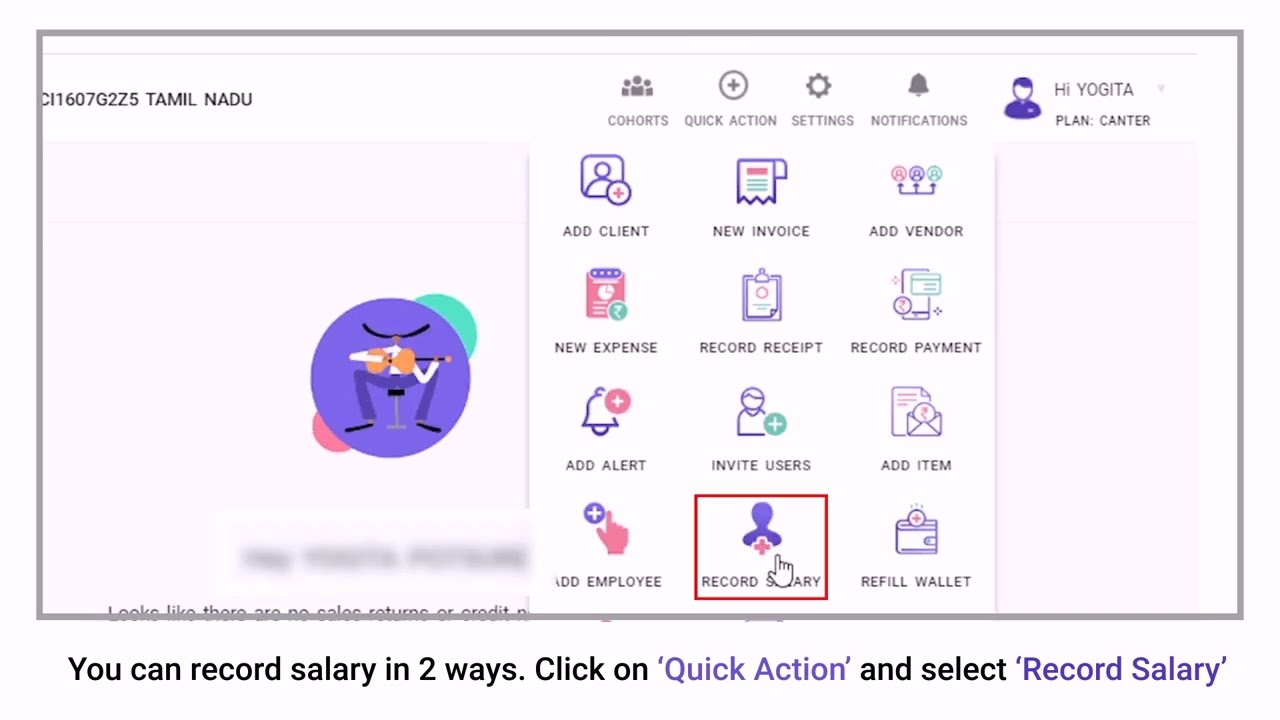

Record payments with a single click

Auto-generates tax compliance documents for all employees

Online doc locker to upload all your employee onboarding documents

Central place to record their photos, certificates and recommendation letters

Easily add and retrieve employee documents with a click