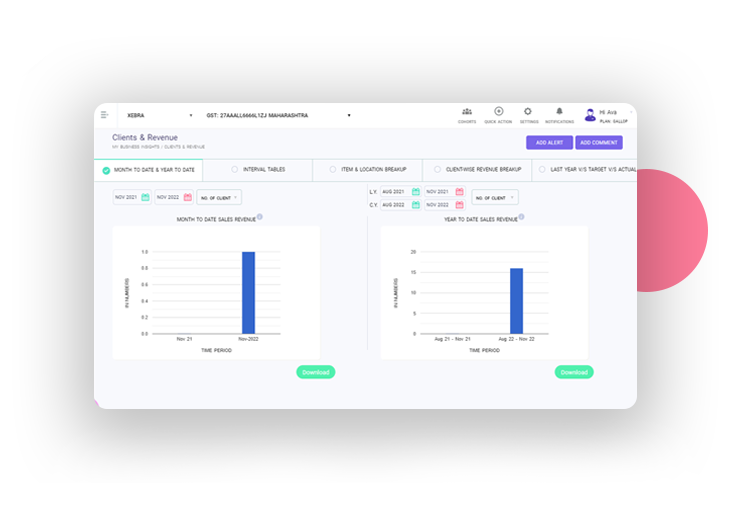

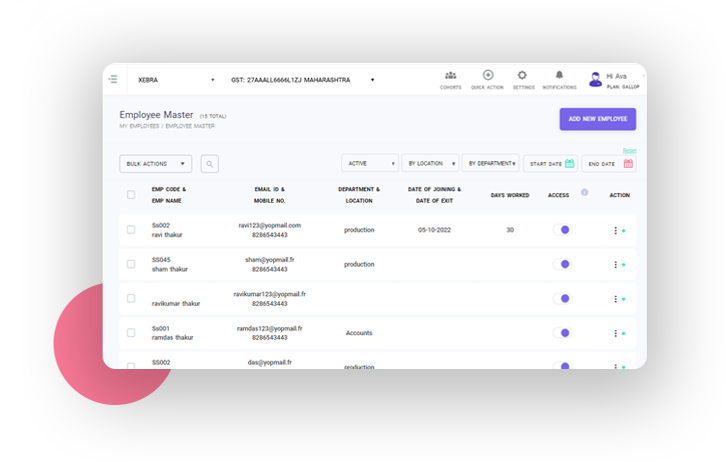

Xebra® connects everyone as a team to ideate, execute and deliver faster & Better

Its modules make it easier to work across multiple locations, departments, companies, stakeholders and even time-zones. Work in silo with your client and vendor or collaborate on projects with your team members